Book Value Vs Tax Cost . Book value and carrying value. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. Companies must value their assets and record them on their financial statements. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. the book value of a company is the difference in value between that company's total assets and total liabilities. Here's how to calculate it and how it impacts. the book value of an asset is an item's value after accounting for depreciation. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is.

from www.chegg.com

book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. Here's how to calculate it and how it impacts. the book value of an asset is an item's value after accounting for depreciation. the book value of a company is the difference in value between that company's total assets and total liabilities. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. Companies must value their assets and record them on their financial statements. Book value and carrying value.

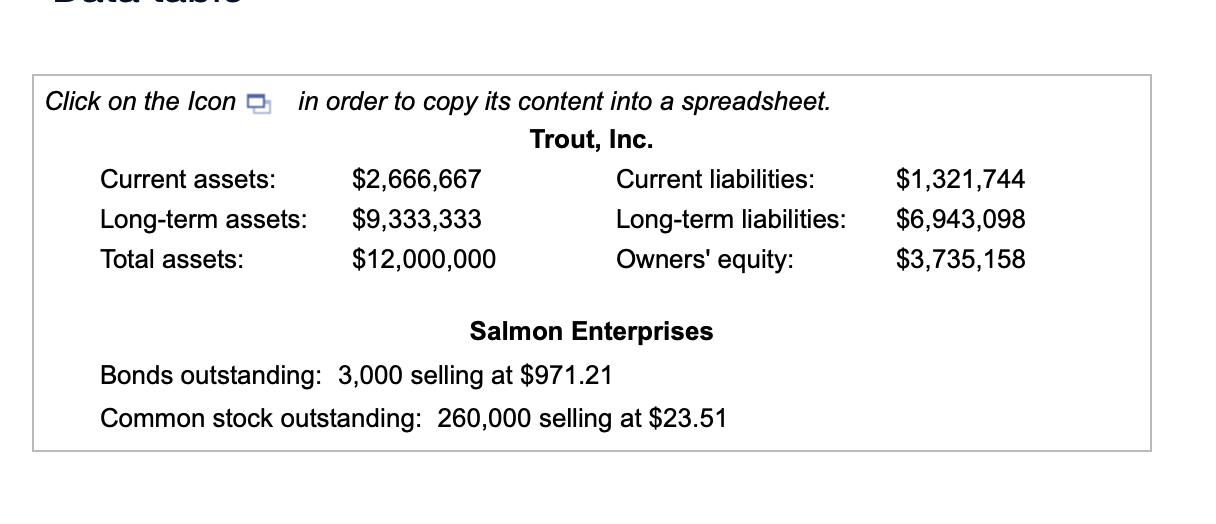

Solved Book value versus market value components. Compare

Book Value Vs Tax Cost the book value of a company is the difference in value between that company's total assets and total liabilities. Book value and carrying value. Here's how to calculate it and how it impacts. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. Companies must value their assets and record them on their financial statements. the book value of an asset is an item's value after accounting for depreciation. the book value of a company is the difference in value between that company's total assets and total liabilities.

From www.askdifference.com

Book Value vs. Market Value — What’s the Difference? Book Value Vs Tax Cost book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. Here's how to calculate it and how it impacts. Companies must value their assets and record them on their financial statements. the book value of a company is the difference in value between that company's total assets and total. Book Value Vs Tax Cost.

From www.ntu.org

What's the Deal With Book Taxes? Publications National Taxpayers Union Book Value Vs Tax Cost Here's how to calculate it and how it impacts. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. Book value and carrying value. the book value of an asset is an item's value after accounting for depreciation. book depreciation is treated as a company’s. Book Value Vs Tax Cost.

From www.youtube.com

Market Value Vs. Book Value YouTube Book Value Vs Tax Cost book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. Companies must value their assets and record them on their financial statements. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. book value refers to the original price you. Book Value Vs Tax Cost.

From www.youtube.com

Book vs. Tax (Accounting for Taxes) YouTube Book Value Vs Tax Cost the book value of a company is the difference in value between that company's total assets and total liabilities. Book value and carrying value. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. Here's how to calculate it and how it impacts. Companies must value. Book Value Vs Tax Cost.

From www.superfastcpa.com

What is the Difference Between Book Value and Market Value? Book Value Vs Tax Cost book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of a company is the difference in value between that company's total assets and total liabilities. Here's how to calculate it and how it impacts. book depreciation is treated as a company’s expense and is recorded. Book Value Vs Tax Cost.

From capitalante.com

The Difference Between Face value Book value and Market value Book Value Vs Tax Cost Companies must value their assets and record them on their financial statements. Book value and carrying value. Here's how to calculate it and how it impacts. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. book value refers to the original price you paid for a security plus. Book Value Vs Tax Cost.

From exoakcage.blob.core.windows.net

Cost Value Vs Book Value at Robert Ferreira blog Book Value Vs Tax Cost the book value of an asset is an item's value after accounting for depreciation. Here's how to calculate it and how it impacts. Book value and carrying value. Companies must value their assets and record them on their financial statements. the book value of a company is the difference in value between that company's total assets and total. Book Value Vs Tax Cost.

From www.wallstreetmojo.com

Book Value vs Market Value of Equity Top 5 Best Differences Book Value Vs Tax Cost the book value of a company is the difference in value between that company's total assets and total liabilities. Book value and carrying value. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. book value refers to the original price you paid for a security plus transaction costs,. Book Value Vs Tax Cost.

From www.slideserve.com

PPT Decentralization PowerPoint Presentation, free download ID3031392 Book Value Vs Tax Cost Companies must value their assets and record them on their financial statements. Book value and carrying value. Here's how to calculate it and how it impacts. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of an asset is an item's value after accounting for depreciation.. Book Value Vs Tax Cost.

From accountingplay.com

Price to Book Ratio Accounting Play Book Value Vs Tax Cost Here's how to calculate it and how it impacts. Book value and carrying value. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of a company is the difference in value between that company's total assets and total liabilities. book value refers to the original. Book Value Vs Tax Cost.

From www.ntu.org

What's the Deal With Book Taxes? Publications National Taxpayers Union Book Value Vs Tax Cost the book value of an asset is an item's value after accounting for depreciation. Companies must value their assets and record them on their financial statements. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. Here's how to calculate it and how it impacts. Book. Book Value Vs Tax Cost.

From www.chegg.com

Solved If the aftertax cost of debt is Book value versus Book Value Vs Tax Cost Book value and carrying value. Here's how to calculate it and how it impacts. the book value of an asset is an item's value after accounting for depreciation. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. book depreciation is treated as a company’s. Book Value Vs Tax Cost.

From www.chegg.com

Solved 11. Book value versus market value components. Book Value Vs Tax Cost the book value of an asset is an item's value after accounting for depreciation. Book value and carrying value. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. . Book Value Vs Tax Cost.

From www.differencebetween.net

Difference Between Book value and Market value Difference Between Book Value Vs Tax Cost the book value of a company is the difference in value between that company's total assets and total liabilities. the book value of an asset is an item's value after accounting for depreciation. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. Book value and carrying value. . Book Value Vs Tax Cost.

From exoakcage.blob.core.windows.net

Cost Value Vs Book Value at Robert Ferreira blog Book Value Vs Tax Cost Book value and carrying value. book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. Here's how to calculate it and how it impacts. the book value of a company. Book Value Vs Tax Cost.

From www.chegg.com

Solved 4. Book value versus market value components. Compare Book Value Vs Tax Cost Companies must value their assets and record them on their financial statements. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement. the book value of an asset is an item's value after accounting for depreciation. Book value and carrying value. Here's how to calculate it and how it. Book Value Vs Tax Cost.

From www.chegg.com

Solved Book value versus market value components. Compare Book Value Vs Tax Cost book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends, corporate reorganizations. Companies must value their assets and record them on their financial statements. Book value and carrying value. book depreciation is treated as a company’s expense and is recorded as a depreciation expense on the income statement.. Book Value Vs Tax Cost.

From exozrkgbh.blob.core.windows.net

Examples Of Book To Tax Differences at Marie Merritt blog Book Value Vs Tax Cost book value represents the carrying value of assets on a company's balance sheet and, in the aggregate, is. the book value of a company is the difference in value between that company's total assets and total liabilities. book value refers to the original price you paid for a security plus transaction costs, adjusted for any reinvested dividends,. Book Value Vs Tax Cost.